Estimate employer payroll taxes

In that case the employer will need to estimate the payroll and payroll-related expenses for the 29th 30th and 31st days of the month. This calculator is for 2022 Tax Returns due in 2023.

Calculation Of Federal Employment Taxes Payroll Services

To pay your estimated quarterly taxes you will need to fill out and file a Form 1040-ES.

. Withholding is reported in the month the payroll is completed. This typically includes State and Federal payroll taxes workers compensation insurance and pension health and welfare contributions for union members. Enter any additional employer taxes.

There is no income limit on Medicare taxes. You will still be subject to income taxes at the federal state levels. One thing businesses cant include is the employers share of Social Security taxes.

Manually calculating payroll and taxes can cost businesses up to 5 or more hours per pay period Sage. The requirement for instalment payments is based on the employers payroll from the prior year. The burden is on you to pay estimated taxes four times a year April 15 June 15 September 15 and January 15 of the following year to cover your anticipated tax bill.

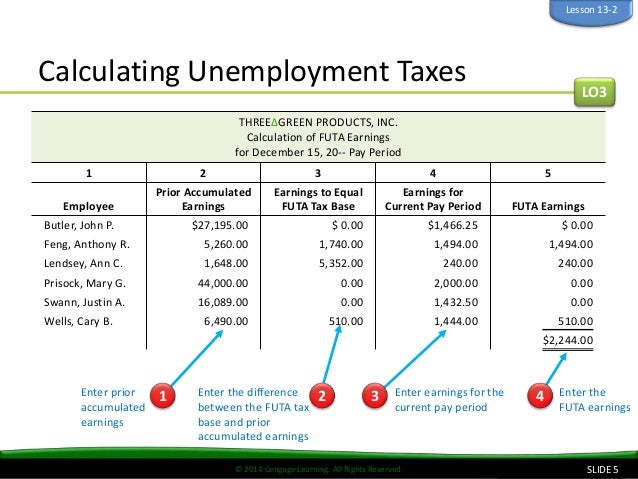

However the employer will continue to pay taxes for every other employee until each employee reaches the UI taxable wage limit of 7000 for the year. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17. WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department.

Depositing Federal Payroll Taxes IRS Form 941 Employers Quarterly Federal Tax Return Outsourcing Payroll Processing. You pay federal income taxes on a pay-as-you-go basis. If you have regular monthly payroll of 210000 per month you will use up your 1000000 exemption after 5 months.

If the weekly pay period ends April 30 it is to be included in the April withholding report. How are taxes calculated. Details such as these may be outlined in the payment agreement between the employer and the contractor.

The payroll tax rate reverted to 545 on 1 July 2022. To estimate your fully-burdened hourly cost for each employee you can enter employee wages and other costs like taxes and workers comp insurance as an hourly cost rate. You can also save on taxes by putting your money into pre-tax accounts like a 401k 403b or health savings account HSA provided your employer offers these options.

However if the pay period should end May 1 it should be included in the May report. Incomplete payrolls at the months end will be included in the month the pay period end. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. Underpaying your taxes triggers a penalty while overpayment is the equivalent of giving the.

Once retired and living on unearned income you will no longer be paying Social Security and Medicare payroll taxes. Those estimates will. Specific fringe costs will vary depending on the work State union involvement and other factors but you can speak with a representative to estimate your payroll fringes.

The employer will no longer pay UI taxes on this individual for the remainder of the year. Itemized deductions statelocal and property taxes capped at 10000 - 0 for Standard Number of dependent children under 17 with SS 0 to 15 Number of non-child dependents 0 to 15. Follow these steps to.

Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to finance government activities. That means your payroll costs starting in May 2021 will begin to be subject to EHT. To determine the cost of the pension the actuary needs four types of information.

Employers who are eligible for a payroll credit that is greater than their total payroll tax liability can apply for an advance credit using Form 7200. Form 1099-NEC to report how much they pay to non-employees each year and independent contractors use Form 1040-ES to estimate and pay their quarterly taxes. This rate expressed as a percent of participating payroll determines the employers contribution.

To fund a future pension you must be able to estimate the cost of that pension. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. Employers who reconcile payroll can avoid discrepancies and costly errors by ensuring employees wages and taxes which are reported to both the Internal Revenue Service and the Social Security Administration match.

If you want to estimate your labor costs between payroll runs or if you dont have payroll you can use estimated hourly costs. Share sensitive information only on official secure websites. The information in this presentation provides general guidance on how to reconcile Forms 941 W-3 and W-2 to gross payroll.

How UI Tax Rates Are Determined UI Pub 214This informational flier explains how payroll tax rates are assigned in accordance with Oregon law and how the benefit ratio is calculated. Fortunately if you would like to file without using a tax professional or tax software you can use the worksheet and instructions that are included with the form to estimate the amounts of income tax and self-employment tax you will be required to pay. This is where the independent actuary comes in.

Retirement accounts like a 401k and 403b not only help you save money for your future but can also help lower how much you owe in taxes. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. Estimate Your 2022 Taxes and Refund.

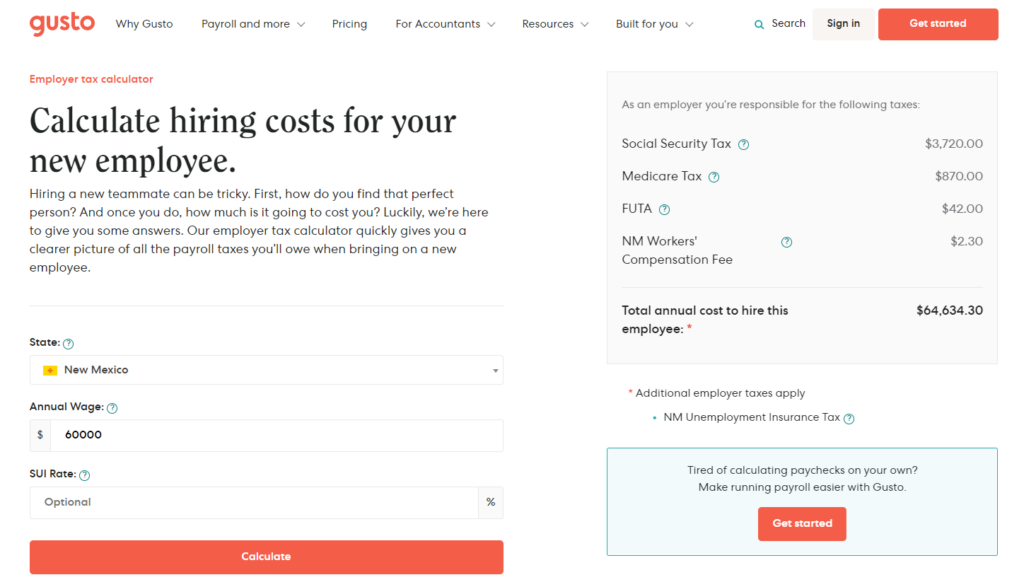

A locked padlock or https means youve safely connected to the gov website. Hours and Estimating Hours Worked UI Pub 211Use the following guidelines to help you estimate hours worked if your payroll system does not track hours. Its essential to consult with an expert but for a rough estimate of what you might pay try using our employer payroll tax calculator.

Instalment Example for 2021. The eligible employers share of Medicare taxes on those wages. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries.

Rates used serve as an estimate only employers individual rates may vary. How to estimate your quarterly taxes. Payroll Taxes Costs and Benefits Paid By Employers.

Payroll Taxes How Much Do Employers Take Out Adp

How To Calculate Payroll Taxes In 5 Steps

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Payroll Calculator On Sale 55 Off Www Wtashows Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Payroll Taxes Wrapbook

Payroll Tax Calculator For Employers Gusto

Tax Payroll Calculator Top Sellers 50 Off Www Wtashows Com

Payroll Tax Calculator Shop 55 Off Www Wtashows Com

How To Calculate Payroll Taxes In 5 Steps

How To Calculate Payroll Taxes Methods Examples More

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Employer Taxes And Employee Taxes Gusto